About Ansergy Reports

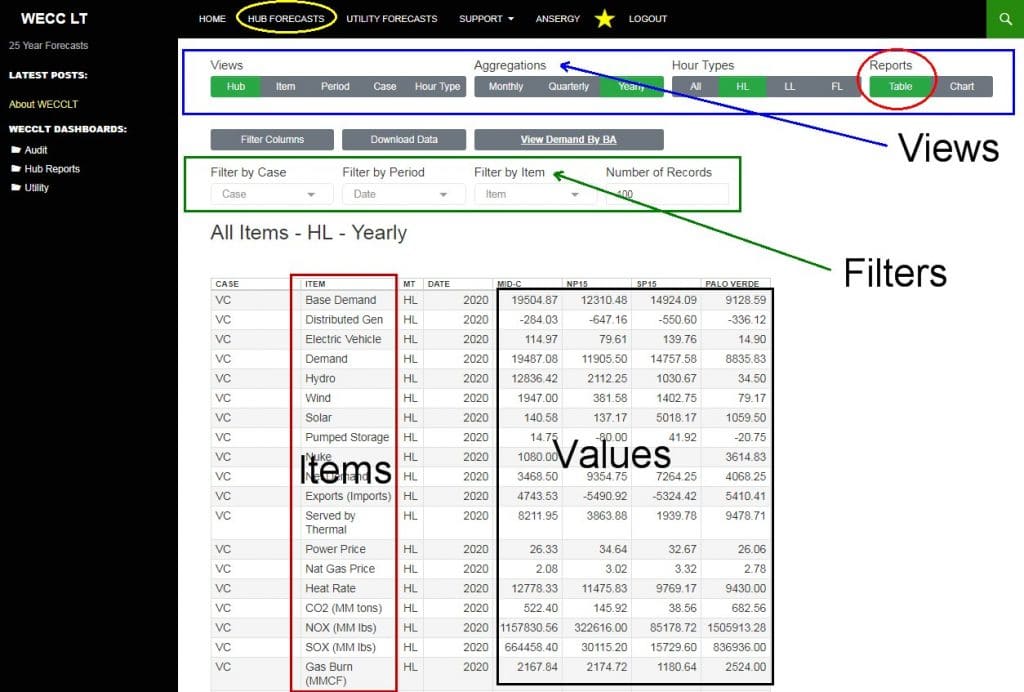

Data is only as good as it is accessible; think needles and haystacks. The WECCLT models generate 797 million hourly forecast records every day; try finding a needle in that veritable universe of haystacks. But it’s not that hard; Ansergy makes it easy to find every needle in just minutes with our proprietary Long Term Interface (LTI). LTI has several features which allow a user to quickly drill down to the most important components of the forecast. We offer five views where we define a view as what the user wants to compare.

Views

-

View By Hub

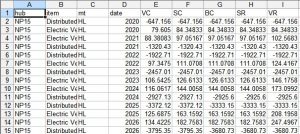

- Â – all 14 hubs are tabulated by column while items, cases, and periods are listed by row

- View the entire WECC in one screen, or filter down to just the hubs of most interest.

- In this view, we have filtered to include Nevada, Utah, New Mexico, and Idaho. The view also consists of all items, cases, hour types, and periods (monthly in the example) though you may want to view just one item for multiple hubs.

- This table includes all demand forecasts for every case and all hour types. Drilling deeper, we can view all cases for just one hour type.

- Now we’ve filtered down to Heavy Load and switched from Monthly to Yearly totals. You may want to see all cases for a single period.

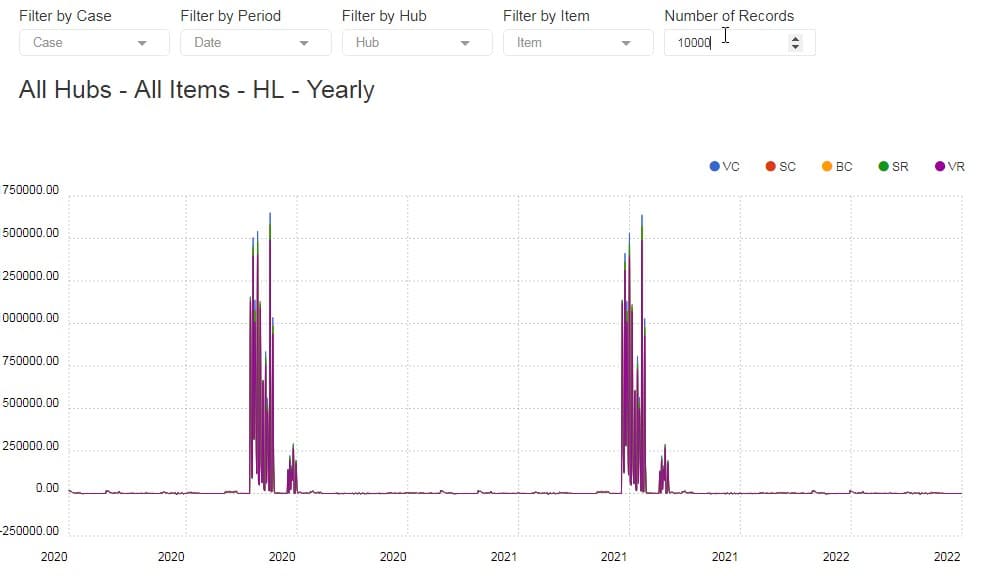

- All data sets can be plotted

- Since it was only one year, the Bar Chart option looks best. What about all the years?

- Multiple dates render best in a line or area chart, so in this example, we selected a line and dropped New Mexico and Idaho from the plot (by unchecking the respective legends). Note that the Utah-Nevada spread is quite volatile for this case (VR). With a click, you can switch items or aggregations.

- With a couple of clicks on the legend, you are now viewing the Colorado-Wyoming quarterly on peak spread for the VR case.

- Reports are easy to make, but Ansergy makes streamlined with our Bookmark Tool (yellow star at the top-right of the menu).

View by Case

Ansergy generates five cases for each run. It is possible that a case can be customized by a user, but Ansergy offers five Standard Cases by default. In the above table, we’ve stacked items by case by year (the first 20 items are displayed, an additional 25 are available). This is a helpful view to drill into why something is changing as you can see individual forecast items by case. It’s simple to change the period. Â We’re looking at 2020, but you can pick any year, quarter, or month (or even all records).

Standard Cases

VC – Very Cheap

This case will return the lowest prices and is comprised of the following assumptions

- Base Demand – a lower, forward-looking base demand forecast which may be driven by a lower GDP, lesser population growth, more conservation, or other factors (apart from Distributed Generation) which would result in declining loads

- Distributed Generation (DG) – also known as rooftop solar, the VC case incorporates the most rapid pace of DG adoption plus a higher penetration rate per capita.

- Electric Vehicles (EV) – The slowest EV adoption rate and assumes a rate less than used by the EIA.

- New Generation – Reserve margins are more than 20% in all hours; the VC case uses a relatively high amount of new generation (solar, wind, and gas-fired power plants)

- Gas Price – assumes continued development of new supply and new pipelines all of which result in the most bearish gas price forecast.

SC – Somewhat Cheap

Less bearish than VC, but the second cheapest of the five cases

- Base Demand – a slightly higher, forward-looking base demand forecast than VC.

- Distributed Generation (DG) – SC incorporates the same DG forecast as VC.

- Electric Vehicles (EV) – Baseline (EIA’s) forecast for EVs

- New Generation – Similar new generation as VC

- Gas Price – a moderately higher gas price forecast than VC

BC – Base Case

Uses all of our Best Guess estimates

- Base Demand – Ansergy’s computed 25-year base demand forecast using ten-year average temperatures and the latest GDP and population growth estimates.

- Distributed Generation (DG) – Ansergy’s baseline DG forecast

- Electric Vehicles (EV) – Baseline (EIA’s) forecast for EVs

- New Generation – Staggered new generation by type for each hub by year

- Gas Price – Ansergy’s baseline gas price forecast.

SR – Somewhat Rich

A more bullish case

- Base Demand – Base Case base demand increased by a small percentage

- Distributed Generation (DG) – Ansergy’s bearish DG forecast; assumes regulatory hurdles or declining retail rates, or increasing solar and battery installed costs

- Electric Vehicles (EV) – Aggressive forecast for EVs which assumes continued regulatory incentives, rapid build outs of charging stations, and high gasoline prices further incentivizing the adoption of EV. This forecast is substantially higher than the EIA’s 25 year EV forecast.

- New Generation – New generation is deferred a few years creating instances where spinning reserves drop beneath 20%

- Gas Price – Ansergy’s bullish gas price forecast. Assumes a flatlining of production and very little change in gas transportation capacities.

VR – Very Rich

The most bullish case

- Base Demand – Base Case base demand increased by a larger percentage

- Distributed Generation (DG) – Ansergy’s bearish DG forecast; assumes regulatory hurdles or declining retail rates, or increasing solar and battery installed costs

- Electric Vehicles (EV) – Aggressive forecast for EVs which assumes continued regulatory incentives, rapid build outs of charging stations, and high gasoline prices further incentivizing the adoption of EV. This forecast is substantially higher than the EIA’s 25 year EV forecast.

- New Generation – New generation is deferred several years creating instances where spinning reserves drop beneath 10%

- Gas Price – Ansergy’s bullish gas price forecast. Assumes a flatlining of production and very little change in gas transportation capacities.

Case Matrix

Custom Cases

Ansergy built WECClt to easily incorporate any sensitivity a user would like to test. These could include the following scenario types.

- Hydro – any water year, any group of water years, or even a random water year for each year of the forecast. The latter may be the most accurate way to forecast since that is how real life works. We can also run capacity tests, for example removing the Lower Snake river projects.

- Temperatures – The standard cases all use the same temperature forecast which is an hourly average of the last 12 years. A user might be interested in testing an ever-increasing temperature and its impact on demand, say a ¼ degree per year. That would result in 2045 seeing about 5 degrees warmer than in 2020. Like hydro, we can also run random temperature years by picking one of the twelve historical years and using those realized temperatures. Temperature and water year can be combined. For example, we could choose 2012 for both the water year and the temperature year.

- Capacity cases – use a different new generation mix. For example, a case could be all nukes retired by 2028, or all coal is retired by 2035.

- Transmission – WECClt uses all known lines plus those currently being built, like the Transwestern Express line. We can also perform what-ifs on hypothetical lines or derated or uprated existing lines. These are exciting studies when modeling long-term locational spreads like SP-MidC.

- Carbon Taxes – Carbon taxes are not a current variable in the standard cases. Sensitivities might include staggered carbon taxes by state.

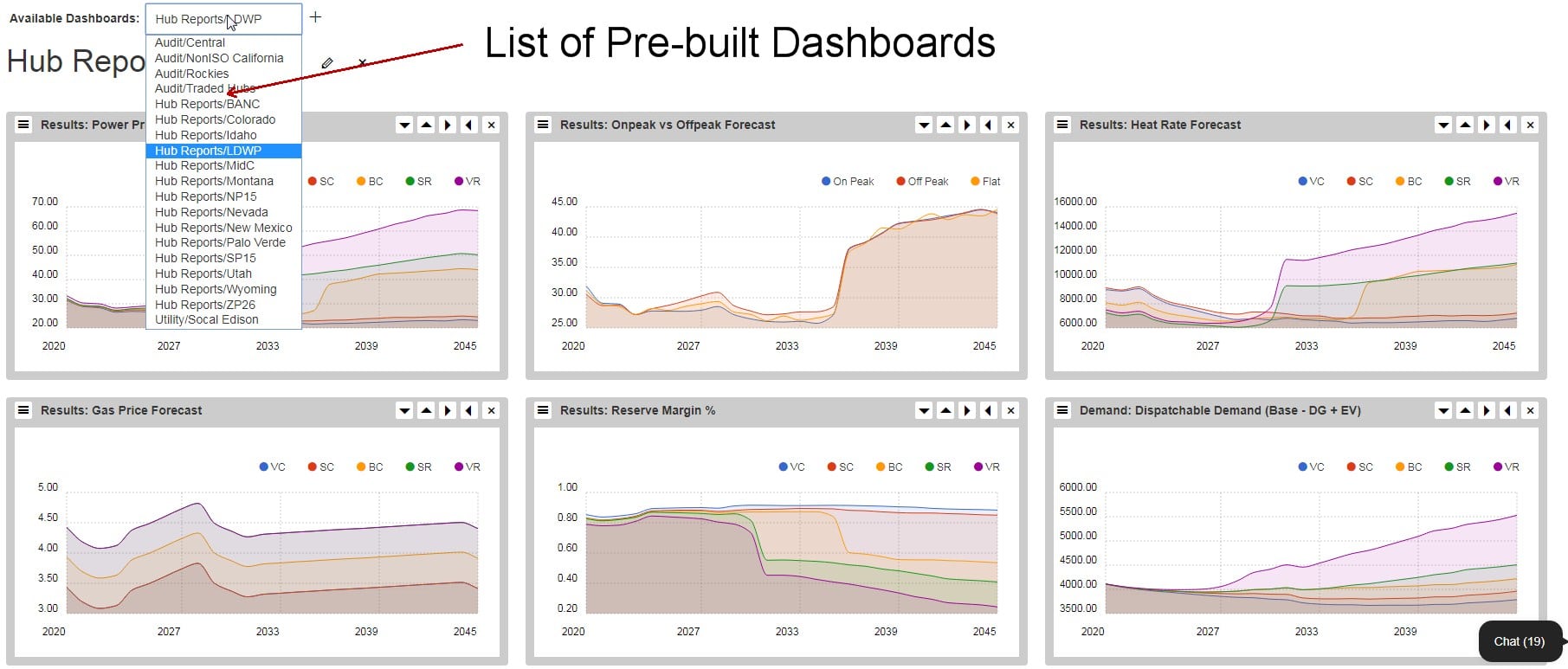

Chart View by Case

Charts are lovely tools for viewing data across time. This plot is for NP’s heat rates for all five cases.

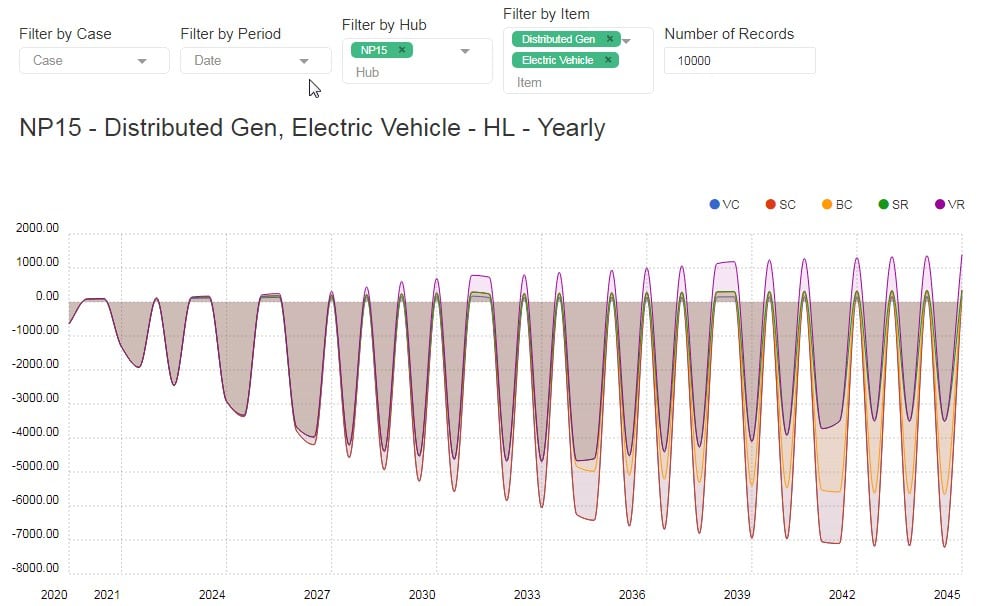

View by Item

Item view is useful for plotting one item against another. Below is an example of the Item View:

Hydro is plotted against Served by Stack for the VC case. The hub isn’t able to keep gas on the margin for a few months each year, and this simulation is done with average water. The problem is exacerbated in heavy water years.

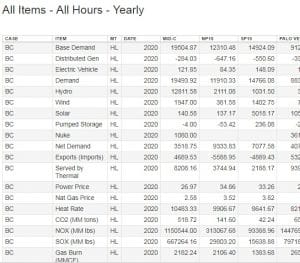

Table View

Easy to download the data, one click and it’s on your desktop.

View by Period

This is a good audit view as it crosses by the period (Month, Quarter or Year).

In the above, we are looking at Demand for the SC case for all hubs by year. You can also drill down and view just one hub, all items.

View by Hour Type

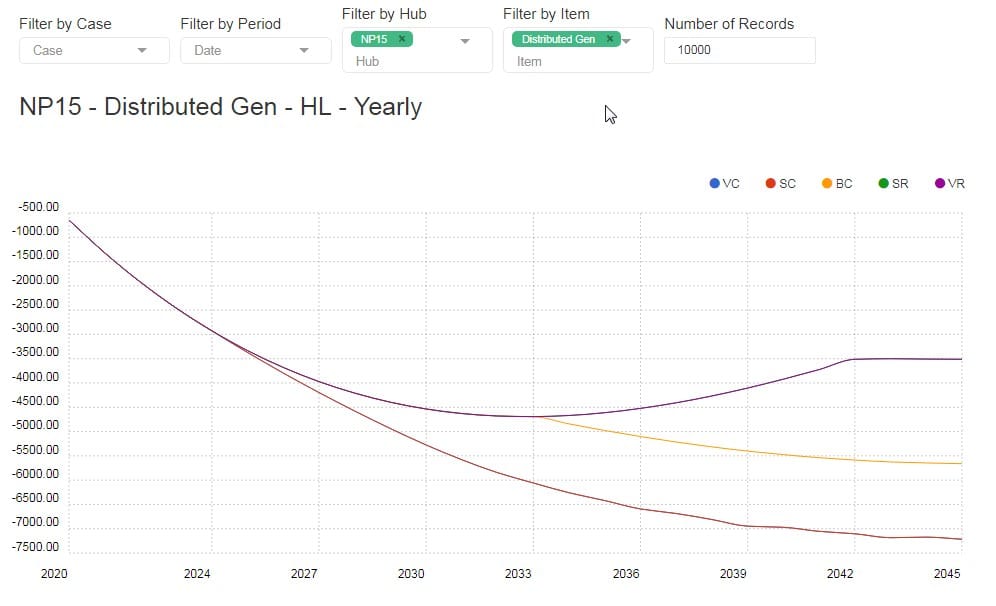

The Distributed Generation forecasts destroy on peak demand during the solar peak. That is best seen in a chart.

Note the upward sloping off-peak demand, partially driven by night time EV load and the plummeting on-peak. Flat also tanks but not like on-peak. Here are the heat rates:

The case is changed, this is VR, but even with the most bullish case, the off-peak heat rate surpasses on-peak by 2035.

Utility Demand Forecast Interface (UDI)

WECC LT loads are computed at a Balancing Authority level and aggregated into Hub Demand. The model calculates four demand types:

- Base Demand

- Distributed Generation

- Electric Vehicles

- Net Demand

All BA load forecasts are available in a related interface:

Click View Demand by BA to download and plot BA-level demand forecasts by demand type. This provides full transparency on what is driving hub-level demand forecasts.

The interface (UDI) is similar to the full forecast interface, with a couple of twists.

Aggregations are still Monthly, Quarterly, and Yearly, though hourly data is available. UDI includes two new hour types:

- Solar Peak – Hours 11-14; this type highlights the peak impact of Distributed Generation on demand

- Evening – Hours 19-22; these are the peak heat rate hours as there is little DG or wholesale solar.

Versions of UDI can include any utility using the EIA 860 splits. Let us know which utility you’d like modeled, and we can provide the data.

This chart is an area plot of San Diego Gas and Electric’s four demand components by year for on-peak. With a click, we can focus on Solar Peak hours:

From this, we see a startling result – negative average loads during solar-peak hours. The utility has become a Genco for the rest of the WECC, the ISO’s second ZP. Need to drill deeper, how about monthly?

Every chart comes with a zoom feature to pick out specific strips of dates, here we’ve zoomed into the June 2029 to October 2032, by month, for the Solar Peak hours.

year hourly price and heat rate forecast.

year hourly price and heat rate forecast.